Show me the (retirees) money!

/Given that all super funds were recently required to publish their retirement income strategy, I thought it would be interesting to see where all that retirement cash is. The answers might not be quite what you would think.

Firstly, AustralianSuper, while the biggest super fund, doesn’t even make top 5 for retirement dollars or members.

Secondly, there’s a lot more retirement dollars and members in retail funds than anywhere else.

Third, Macquarie comes in at number 10. Mac Wrap is nowhere near a top 10 super fund, but it does have a lot of er, mature, members.

Here are the stats. As at June 30 2021^, there were 1.3 million tax-free* accounts, aka pension accounts. I’m going to refer to them as pension accounts, since that’s what most of us call them IRL.

As you can see below, when we look at total FUM vs pension FUM, there’s a lot less pension FUM in industry funds, instead it’s with public sector and retail. Note the lack of SMSF** data.

Share of total FUM by sector

Share of pension dollars by sector

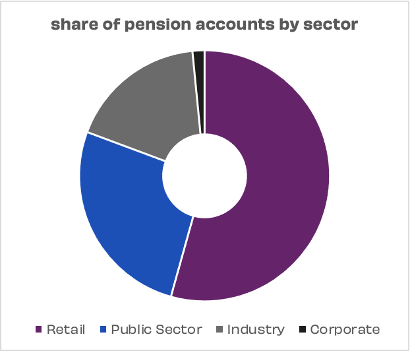

And then when we look at accounts, you see that more than half are in retail accounts.

Share of pension accounts by sector

The average account size is highest in corporate funds, but that’s a tiny part of the pie. Public sector is really the place to be, all those lovely massive DB accounts enjoyed by our senior public servants and politicians. Of course, you had to have joined them 20-30 years ago, but that’s life eh?

So that’s the macro picture.

Next, let’s have a look at the top 20 organisations by number of pension accounts. Commonwealth Super Corporation (CSC) leads the way, followed by a bunch of retail funds. In fact, CSC, CFS and Insignia each have more pension accounts than all the non-top-20 funds combined.

Number of pension accounts

When we then look at FUM, the order is the same, but CSC’s average account balance means that they have a LOT more of the money.

Pension FUM $

What’s interesting here is that pension FUM is only loosely correlated with the total super FUM of the organisation. There’s only one ‘monster’ pension fund, and that’s CSC.

There are a number of reasons for this. Firstly, many industry super funds didn’t even offer a pension option until the last 10 years or so. It used to be ‘here’s your cheque, enjoy your retirement’! Secondly, the demographics of who each fund has as their target market. Noting of course that this is more the result of industry structure than anyone doing anything particularly amazing on the marketing front.

Pension FUM vs total FUM

The average account size is more of a mixed bag. Across the industry, the average pension account balance is $363k, a tidy sum.

There are some clear outliers. For instance, Unisuper’s average pension account size is almost as high as CSC, presumably a result of the very generous super contribution arrangements enjoyed by many university employees. It really does make a significant difference when employers join the super party.

And at the other end, EQT Super is showing a very low balance. Frankly this doesn’t make a whole lot of sense to me, so it might be more of a data issue than an accurate reflection of reality.

Average pension account size

Having been in marketing/product/comms for many years, it’s pretty standard to want to increase the average balance per client, on account of the fact that many of the costs in super are at the fund level, so less clients with higher balances = more profit. (Did I mention I used to work at Mac Wrap? Lol).

It’s an interesting conundrum for pension accounts. These accounts can’t get bigger, only smaller. And it’s a fairly well established fact now that many members would be better off taking more out of their pension account, so running campaigns along the lines of ‘please don’t take out your money’ aren’t going to fly.

So what then? Are we going to see significant differences between the level of service that some funds can provide to their retired clients compared to others? I would suggest yes. Are we going to see funds actively promote their fund as a ‘place to put your retirement savings once you’ve retired'? I think yes to that too. Plus, I would suggest that adjunct services in retirement are WAY more valuable than anything provided pre-retirement. Interesting time ahead me thinks.

I’m very interested to know what you all make of these figures. This is the first time I’ve done this analysis, and while I suspected that retail funds would have the biggest percentage of pension accounts, I certainly didn’t expect it to be more than half! Are there any surprises for you? Do you think my analysis/comments are wrong/missing something? Please do let me know. My mantra with this sort of thing is ‘strong opinions, loosely held’, so I’m more than willing to adjust my thinking to incorporate new ideas and evidence. Join the conversation here.

^ yep, the data is a year old. I’ll do an update when the June 2022 data comes in, but that will be a while yet.

*I could refer to these as retirees. However, as we know, some people don’t start drawing down on their super until they’ve been retired for some time, and some people are drawing down who haven’t retired yet. So I’m going to stick with ‘pension’.

** This data doesn’t include SMSF. I did try, but the ATO info is a bit crap compared to what you can get from APRA.